Amid the Medicare open-enrollment period from October 15 to December 7, older Americans face an escalating wave of scam calls targeting their benefits. Approximately 62.8 million Medicare beneficiaries nationwide are enduring relentless robocalls, as fraudsters hunt for Medicare numbers and recorded “yes” responses to enable bogus billing.

Seniors receive hundreds of unsolicited calls daily, turning what should be a routine enrollment period into a source of stress and financial risk. One expert notes, “You can’t get curative care if you’re marked as receiving hospice and you didn’t even know it.” Here’s what’s happening with these scams and why vigilance is more critical than ever.

Scam Surge During Enrollment

During open enrollment, legitimate health-plan marketing peaks, giving scammers cover to blend in with official calls. High call volumes increase the odds seniors answer, while inexpensive robocalling technology lets criminals bombard entire regions nonstop. Complaints to Better Business Bureaus have surged 40 percent year-over-year, marking this period as a critical fraud hotspot.

Fraudsters exploit familiarity with Medicare communications, imitating insurers, suppliers, and government representatives. Seniors often cannot distinguish legitimate outreach from scams, making the open-enrollment window particularly vulnerable. Technology and timing together amplify the threat, leaving millions of beneficiaries exposed to potential financial and medical harm.

Daily Harassment for Seniors

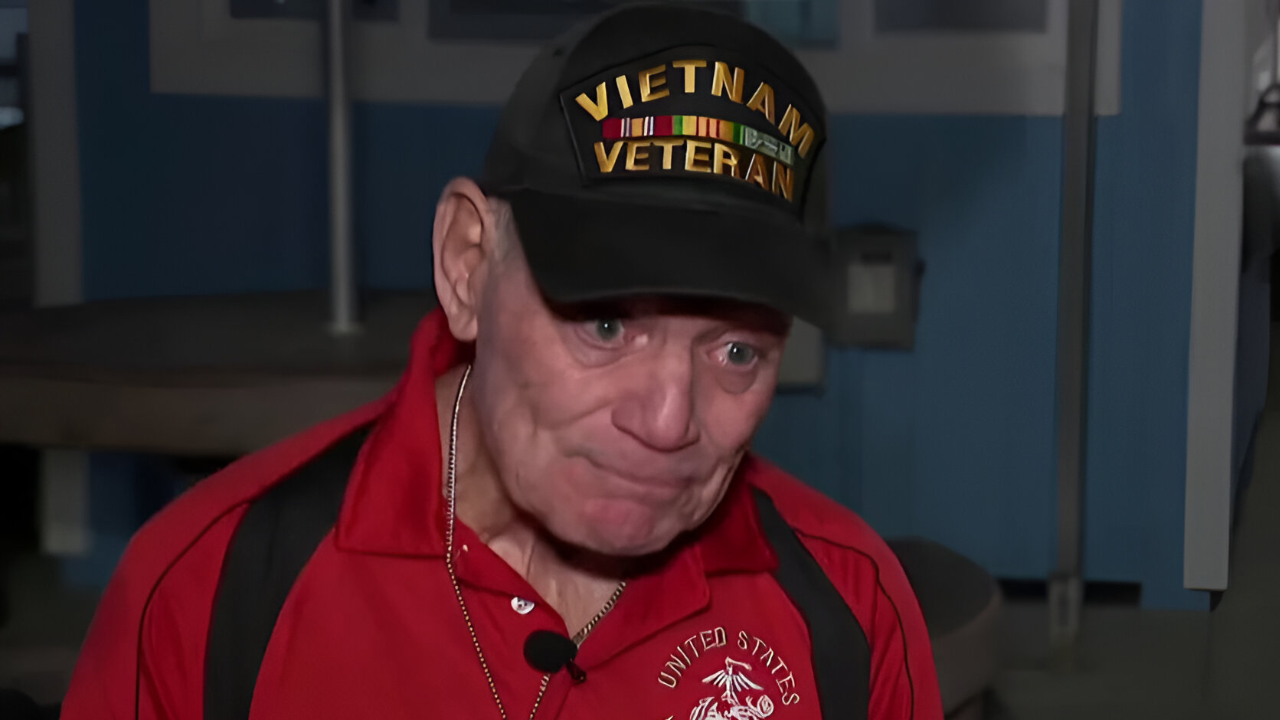

Robocalls have become relentless. In Pennsylvania, an 80-year-old senior fields 50 to 60 Medicare scam calls on weekdays—one every 14 minutes from dawn to dusk. In California, a 75-year-old receives one or two hourly. Phones, vital for doctor visits, pharmacy alerts, and family ties, now double as a source of anxiety and potential fraud.

These constant interruptions force seniors into impossible decisions: ignore essential calls or risk exposing personal information. The psychological toll is substantial, with sleep disruption, heightened stress, and social isolation becoming common among those targeted by daily harassment.

The “Yes” Trap and Fraud Mechanics

Scammers often prompt seniors to confirm identity or benefits. A recorded “yes” response, combined with breached data, can greenlight fraudulent charges for unneeded braces, tests, diabetes gear, or other medical equipment. Fraudsters harvest personal details via data breaches and spoofed calls, turning a single confirmation into widespread identity theft.

This approach is efficient and difficult to detect. Once scammers gain access, they can file multiple claims across state lines, draining federal and private funds while leaving beneficiaries responsible for unexpected charges. The consequences can cascade quickly, affecting credit, medical records, and retirement savings.

Real Billing Fallout

In Clarksville, Texas, an 80-year-old resident discovered six fraudulent charges totaling approximately $1,200 on her Medicare account in 2024, including $714.83 for orthopedic braces she never ordered. Her Blue Cross Blue Shield secondary plan paid $572.27 for the same fraudulent charges.

These cases highlight the financial strain on individuals, providers, and taxpayers. Fraud forces providers to correct errors and insurers to absorb unexpected costs, while seniors face stress and depleted retirement funds. Even small-scale scams can create a ripple effect across the healthcare system, threatening both personal security and program integrity.

Scale and Enforcement Challenges

Automated systems pump billions of calls monthly at minimal cost, spoofing IDs and bypassing call-blocking tools. Fraudsters leverage breached Medicare data to identify vulnerable seniors and file cross-state claims rapidly. Federal rules require call authentication, yet as of September 2025, only 44 percent of phone companies have fully installed mandated software, leaving major gaps.

This enforcement lag allows scammers to operate largely unchecked. Regulatory improvements and carrier accountability are critical, but seniors must remain vigilant while technology and law enforcement catch up. The sheer scale of automated fraud demonstrates systemic vulnerabilities that extend beyond individual victims.

Human and Economic Toll

Endless robocalls spark anxiety, sleep loss, and isolation for seniors, while families bear stress implementing protective measures. Trust in legitimate Medicare or insurer contacts erodes, leading to missed enrollments and disrupted care. According to the Federal Trade Commission, phone scam victims lost an average of $3,690 in the first half of 2025, while older adults report median losses of $1,000 to fraud overall.

The FBI’s 2023 data shows that 5,920 individuals over 60 lost more than $100,000 each, with average losses per complaint of $33,915. Beyond financial impact, fraudulent activity injects false diagnoses, medications, or hospice flags into medical records, potentially affecting care for years, highlighting both the human and economic stakes of Medicare scams.

Protection Steps Ahead

Seniors are advised to guard Medicare numbers like credit cards, hang up on unsolicited calls, and verify inquiries through publicly listed channels. Checking Medicare Summary Notices regularly and reporting suspicious activity to Senior Medicare Patrol can prevent fraud escalation. Call-blocking applications filter billions of spam calls but may miss sophisticated spoofs.

Regulators are enforcing stronger carrier penalties and enhanced call-tracing protocols, aiming to balance scam prevention with legitimate outreach. Systemic improvements, user vigilance, and technology upgrades will determine whether protections can keep pace with evolving threats, safeguarding healthcare access and financial security for 62.8 million vulnerable beneficiaries.

SOURCES

“Medicare Scammers Are Calling Seniors 50 to 60 Times a Day.” The New York Times, December 5, 2025.

Medicare Monthly Enrollment. Centers for Medicare & Medicaid Services (CMS), November 25, 2025.

“Medicare Scam Calls: What You Need to Know.” WellMed Healthcare, November 4, 2025.

“Seniors are Flooded with 60 Medicare Scam Calls Daily.” GeekSpin, December 8, 2025.

“Americans Are Getting 2.5 Billion Robocalls a Month.” CBS News, October 16, 2025.

Senior Medicare Patrol guidance. Centers for Medicare & Medicaid Services, ongoing.

“New FTC Data Show a Big Jump in Reported Losses to Fraud.” Federal Trade Commission, March 2025 (covering 2024 data).

“2023 Elder Fraud Report.” Federal Bureau of Investigation Internet Crime Complaint Center (IC3), 2023.